The bull market lasted so long that a lot of folks forgot about this classic strategy…

After all, stocks have trudged higher since the housing bust in 2009. And they’ve done so with incredible consistency. The S&P 500 Index has only seen a small number of corrections since 2010.

Still, if you’ve been an investor since before the last bust, I bet this strategy will sound familiar…

I’m talking about the “Dogs of the Dow.”

Michael B. O’Higgins popularized the stock-picking strategy in the 1990s. And when times start getting tough, it pops back into the limelight.

You see, the Dogs of the Dow strategy is a contrarian model. It’s specifically designed to outperform in rough markets.

So with the S&P 500 down about 6% this year, it’s a great time to revisit this strategy.

In today’s essay, I’ll go over the details of the Dogs of the Dow strategy, talk about an easy way to play it in your brokerage account, and share how it’s performing right now…

In short, the Dogs of the Dow is an annual system. Each year, investors are supposed to pick the 10 stocks from the Dow Jones Industrial Average with the highest dividend yields.

Now, that can get a little confusing. But the basic idea is that the stocks with the highest dividend yields are also the stocks with the most unfavorable price action at the time.

In other words… when the price of a dividend-paying stock falls, the percentage of its dividend (compared to its price) goes up. So in practical terms, that means you end up buying the Dow stocks that have struggled the most over the past year – the Dogs.

As far as upside, the idea is that those stocks must be “oversold.” After all, we’re not talking about small-cap companies here… We’re talking about the 30 large-cap stocks in the Dow.

Better still, in bear markets, the big dividend payouts can help cushion any downside.

We could make our own Dogs of the Dow portfolio. But let’s keep things simple today. Instead, let’s use an exchange-traded fund (“ETF”) that gets us close enough to our goal…

The Invesco Dow Jones Industrial Average Dividend Fund (DJD) weighs its holdings based on their dividend payments. In the end, it’s very close to the Dogs of the Dow strategy.

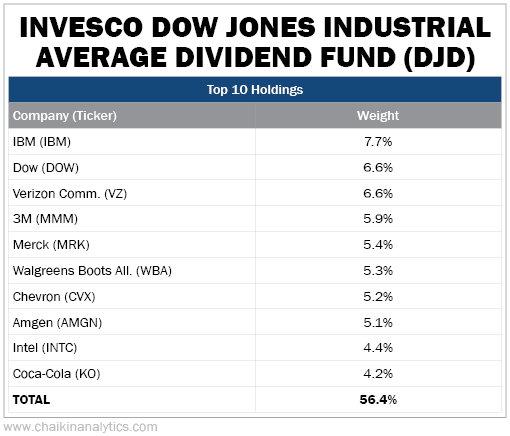

Here’s the breakdown of its top 10 holdings today…

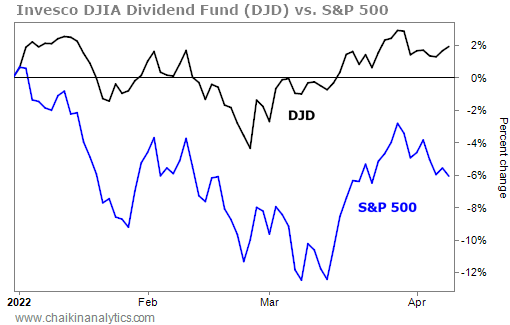

These top 10 holdings make up roughly 56% of the ETF. And more importantly, the ETF is helping investors weather today’s economic storm. Take a look…

The S&P 500 is down roughly 6% this year. But if you would’ve focused on the highest dividend-paying stocks by owning DJD shares, you would be up around 2%. And that’s before you factor in the ETF’s 2.8% dividend yield.

Of course, these returns obviously aren’t mind-blowing numbers. But the broad market is down about 6%. DJD’s outperformance shows it isn’t a bad way to weather the storm.

And if nothing else, you’ve gotten a refresher on the Dogs of the Dow strategy. Now that it’s outperforming the market, I’m sure you’ll soon hear it come up in the mainstream media.

Good investing,

Pete Carmasino