I don’t know about you, but I’ve never lost a moment of sleep worrying about rising rates…

And that’s despite having a significant part of my overall portfolio dedicated to fixed income. After all, I’m hoping to have a steady stream of income in retirement.

The Federal Reserve’s shenanigans don’t matter to me. It’s OK if interest rates are falling… And it’s OK if they’re rising, too.

Put simply… building retirement income isn’t supposed to be an edge-of-your-seat ride.

Fortunately, managing your retirement yourself is easier than you might imagine. It all comes down to how you interact with the bond world…

My colleague Karina Kovalcik and I recently explained why investors should steer clear of conventional bond exchange-traded funds (“ETFs”) – or “pseudo bonds.” Folks are better off directly owning bonds or investing in “target date” bond ETFs.

The key reason is simple…

We want to own securities with maturity dates, rather than ones with perpetual existence.

Maturity dates are important for managing risk in times of rising interest rates. And today, I want to show you how to do that with a simple technique. It’s called “laddering”…

In short, laddering involves creating a portfolio of bonds with differing maturity dates.

Professional investors do it with individual bonds. But as I noted in my April 29 essay, it’s much easier for individuals to use the BulletShares target-date ETFs from Invesco.

With that in mind, let’s go over an example of portfolio laddering that you could do today…

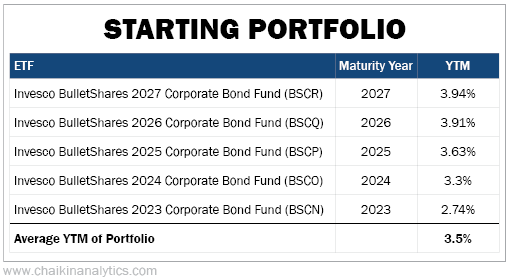

Again, we’re using the Invesco BulletShares ETFs. The following tables will also show the current “yield to maturity” (“YTM”) for each ETF. You can find that information on the ETFs’ official pages.

Unlike yields published on most websites, YTM is essentially an estimate of the total expected return. It includes gains or losses as the principal value approaches the full payout at maturity. It also includes any interest earned while reinvesting dividends.

Let’s assume we begin with five positions. And we invest an equal dollar amount in each ETF. Here’s what our starting portfolio would look like…

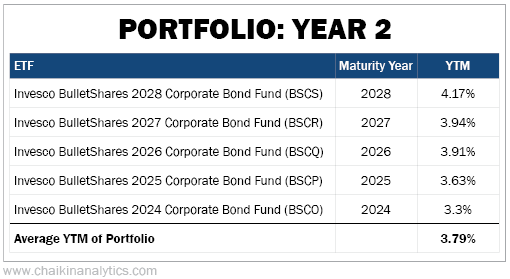

At the end of each year, we’ll sell the shortest-maturity bond and reinvest the proceeds in the ETF with the next maturity date. That approach would extend our ladder by one “rung.”

So at the end of the first year, we’ll sell the Invesco BulletShares 2023 Corporate Bond Fund (BSCN). And we’ll put the money into the Invesco BulletShares 2028 Corporate Bond Fund (BSCS), which matures in 2028. Take a look…

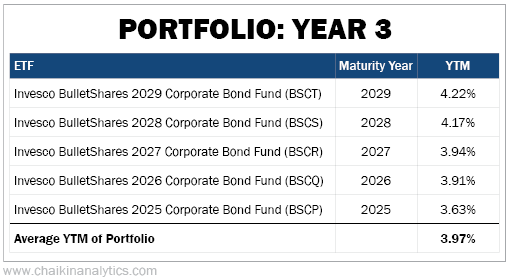

At the end of the second year, we’ll sell the Invesco BulletShares 2024 Corporate Bond Fund (BSCO). And we’ll invest the proceeds into the Invesco BulletShares 2029 Corporate Bond Fund (BSCT)…

We’re climbing the maturity ladder one rung per year. It’s a simple approach. Yet it accomplishes a lot…

Notice how our overall portfolio’s YTM increases each year. We replace our lowest-yielding rung with a higher-yielding ETF. That helps us keep building our income stream.

Now, since bond yields and prices move inversely, I know what you might be thinking… If interest rates rise, won’t we lose money as ETF prices fall?

With conventional bond ETFs, the answer is a definitive “Yes.” But it’s different with actual bonds or these bond-like BulletShares ETFs. Instead, the answer is “Yes, but…”

You see, we can hold real bonds or the BulletShares ETFs until maturity. And if we do that, we’ll be paid for every dollar that we’ve invested. That’s what happens in our example to BSCN at the end of the first year… BSCO at the end of the second year… and so on.

Also remember that we’re dealing with YTMs instead of simple yields. The math can get complicated. Just know that regardless of how interest rates move in the market, the price of the bonds will gradually move toward a full repayment.

It’s really that simple. And it’s why I can sleep well no matter what happens with the Fed.

Good investing,

Marc Gerstein