Milton Friedman often called inflation the “cruelest tax”…

The late, great economist is best known as the godfather of the Monetarist school of thought. His guiding principle revolved around the quantity of money…

In short, throughout his decadeslong career, Friedman focused on how much money the Federal Reserve put into the economy… The more money that’s pumped in, the higher the potential for inflation.

Friedman also said, “Inflation is always and everywhere a monetary phenomenon.”

In other words, the Fed causes inflation.

And inflation is the “cruelest tax” because it erodes more than just the value of the money you earn in the present… It also diminishes the purchasing power of what you already have, as well as what you’ll earn in the future.

It’s a tax that everyone pays, but nobody collects.

Inflation is front and center on everyone’s minds right now. It’s hitting multidecade highs. But as I’ll show you today, you can fight the cruelest tax with one simple investment…

Let’s start with the most recent news…

The U.S. Bureau of Labor Statistics announced earlier this month that the Consumer Price Index – a fancy term for “inflation” – surged 6.8% on an annualized basis in November. That’s the largest 12-month increase since June 1982.

Now, anyone who drives a car could tell you that it costs more to fill up the gas tank than last year. And pretty much anyone who goes to the supermarket or buys clothing knows that everything is more expensive now than just a few months ago… That’s inflation.

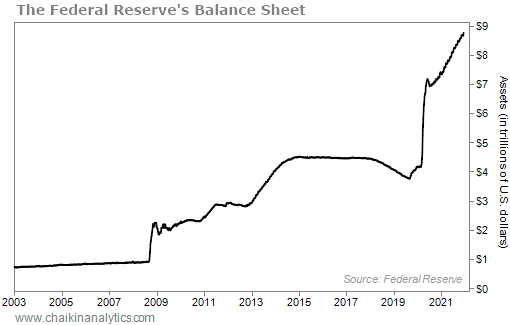

And Friedman was on to something, too… It’s clear that the Fed has been busy contributing to the cruelest tax over the past several years. Look at the central bank’s balance sheet…

This chart from the Fed shows that it owns nearly $9 trillion of “assets” today.

The central bank buys longer-term bonds from the open market in order to increase the money supply. It hopes these efforts lead to lending and investment. This is what people mean when they say the Fed is printing money… It’s also known as “quantitative easing.”

And in the wake of the COVID-19 crisis, that money dam just burst on inflation.

Simply put, Americans are currently paying the cruelest tax… And the Fed is behind it.

But you don’t need to just sit on your hands and watch the value of your savings disappear. Instead, you can go on the attack with an investment that thrives when inflation spikes…

I’m talking about housing.

You see, buried within the reported monthly inflation data are increases in specific items. You’ll find tidbits about food, energy, gasoline, and even “shelter” – in other words, housing.

And according to one major investment bank, this trend will last well into next year…

Goldman Sachs recently published a report that indicates “a higher peak for shelter inflation” in 2022. Researchers believe it could peak at around 6% early next year.

Now, that’s great news if you own real estate. It means prices should keep moving higher. But you can also play this trend in a much easier way today…

In short, you can buy an exchange-traded fund (“ETF”) in the housing sector.

And our proprietary “Power Gauge” system has sniffed out the best ETF for this potential boom. As you can see, it’s “very bullish” on the SPDR S&P Homebuilders Fund (XHB)…

All of the major U.S. homebuilders are among XHB’s 35 holdings, including NVR (NVR), D.R. Horton (DHI), and Toll Brothers (TOL). The ETF also includes other home-related stocks… For example, its largest holding right now is in appliance maker Whirlpool (WHR). And it also owns home-improvement retailers Home Depot (HD) and Lowe’s (LOW).

The Power Gauge is currently “bullish” or better on all of those companies.

In the end, Friedman’s “cruelest tax” might be eroding your purchasing power today… And that trend could continue well into the new year. But as you’ve seen, you can fight against it and juice your investment power with a stake in the housing sector through shares of XHB.

Good investing,

Carlton Neel