Many folks feared the worst for Big Oil when Joe Biden became president…

After all, Biden’s campaign included a big focus on “clean energy” sources – like wind and solar. He emphasized plans to shift the U.S. toward low or zero carbon energy production, “green” industry manufacturing, and other climate-friendly initiatives.

A move toward clean energy, of course, could be disastrous for oil and gas companies.

Heck, this narrative is still popular… I’m sure you’ve seen the news stories about Biden’s Build Back Better bill. It includes hundreds of billions of dollars set aside to fight climate change.

But when it comes to what this all means for the markets… the mainstream media are way off the mark. Simply put, you shouldn’t listen to the talking heads.

Someone in your life has also likely mentioned gas prices and Biden together in recent months. This type of real-world experience paints a much different picture for oil and gas companies right now.

We can see the reason why in the data…

According to the U.S. Energy Information Administration, the cost of gasoline averaged $2.10 per gallon in the country on November 9, 2020… That was about a week after Biden won the election.

Now, the average gas price in the U.S. is roughly $3.35 per gallon. In other words, since Biden was elected president… gas prices are up roughly 60% in a single year.

That might be rough for American consumers like you and me. But how do you think all the companies that drill for oil, refine it, and sell it to you as gasoline are doing these days?

The easiest way to see this is through a broad collection of energy companies – like an exchange-traded fund (“ETF”).

The largest energy sector ETF by far is the Energy Select Sector SPDR Fund (XLE)… It tracks the sector through shares of about 20 companies at any given time.

XLE’s top two holdings are household names – ExxonMobil (XOM) and Chevron (CVX). It also includes oil and gas producers EOG Resources (EOG) and ConocoPhillips (COP), as well as oil-services companies Schlumberger (SLB), Halliburton (HAL), and Baker Hughes (BKR).

So there’s no question about it… XLE is an accurate reflection of Big Oil.

And in turn, its share price accurately reflects what’s happening right now. Contrary to what the mainstream media might lead you to believe about these companies, XLE is doing great…

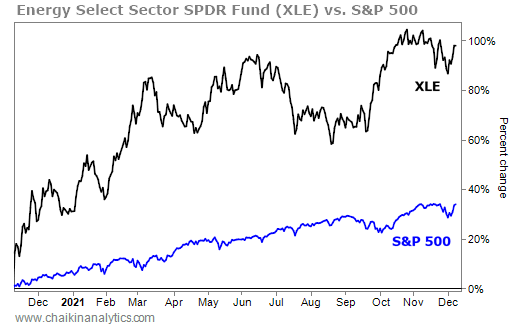

As you can see, XLE is up around 97% since early November 2020. The S&P 500 Index – our broad measure for the stock market – is only up about 34% over the same period.

In other words, this energy ETF’s return nearly tripled the S&P 500’s gain in that span.

But that doesn’t mean you’ve missed the boat. There’s still plenty of upside ahead…

Like it or not, Congress will likely pass the Build Back Better Act in one form or another. And if you follow the news at all, you know that Senator Joe Manchin is key to the vote…

Manchin is a Democrat. He was born in a small coal-mining town in West Virginia to a family with a lot of influence in the region. As a result, despite his Democratic Party ties, Manchin opposes his colleagues’ efforts to include provisions in the bill aimed at ending fossil fuels.

The Democrats need Manchin to get the deal done. And that means they won’t be able to go too hard on energy companies in the final measure… Big Oil will be just fine in the end.

So today, make sure you keep XLE on your radar…

It has already doubled the returns of the S&P 500 over the past year. And everything happening right now points to more gains ahead… regardless of what the pundits say.

Good investing,

Carlton Neel