About 22 years ago, I ate lunch with office colleagues who sang the same tune every day…

They couldn’t get enough of their favorite Internet stocks.

You see, it was the peak of the dot-com boom…

It was a new job for me. I didn’t want to act like a snob. So I sat silently and tried to avoid rolling my eyes.

I even tried to come to terms with dot-com stocks in early 2000. I dabbled a bit in the space.

But then, on March 20, 2000, Barron’s published a major tome by columnist Jack Willoughby. He said that many dot-com firms were running out of cash – and that many probably wouldn’t survive.

My new colleagues thought Willoughby was a jerk. I remained silent. But immediately, I realized Willoughby was spot on. And fortunately, in an instant, I regained my sanity…

I didn’t like the idea of being a lunchtime wallflower. But more than that, I didn’t want to go broke.

So I quickly and quietly got rid of my few Nonsense.com stocks. Then, I went back to the basics…

I built screens based on fundamentals (earnings, balance sheets, cash flows, valuation ratios, and other metrics). Not surprisingly, a lot of boring, no-name companies popped out.

Now, I wasn’t making money hand over fist. But importantly, I never felt a sense of dread. I always felt comfortable with my portfolio, all things considered.

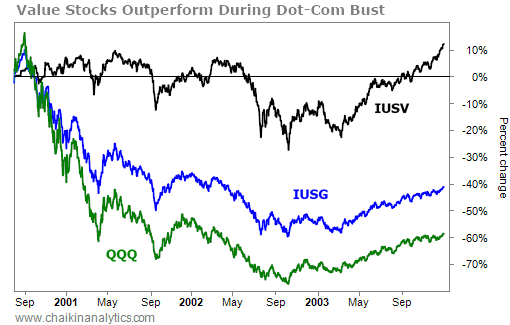

My old brokerage account records are long lost. But the following chart supports my memory of value stocks serving me well…

As you can see, the iShares Core S&P U.S. Value Fund (IUSV) beat the daylights out of the iShares Core S&P U.S. Growth Fund (IUSG) during the dot-com bust. And both exchange-traded funds left the more tech-heavy Invesco QQQ Trust (QQQ) in the dust…

I must be clear… this strategy did not work during the 2008 bust.

The market turmoil in 2008 involved a rare banking crisis that threatened the entire financial system. And investors simply headed for the exits in response. Everything collapsed back then.

Fortunately, that’s not where we are today…

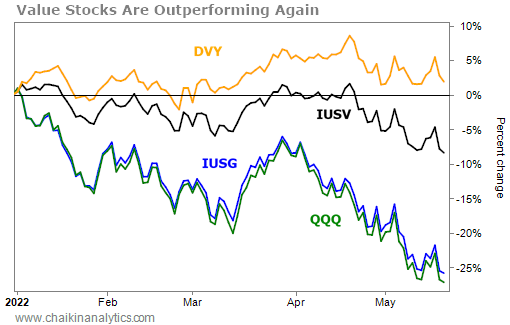

The next chart shows an overarching similarity between the dot-com bust and today. Things might be bad this year, but investors are still making distinctions. You can see it clearly on this final chart…

Notice that I also added the iShares Select Dividend Fund (DVY) to this final chart. I discussed that exchange-traded fund last Wednesday as a “recession fortress.” And I believe it would’ve made a similar showing in the dot-com bust if it had been around then.

Folks, the takeaway is simple…

Value stocks and dividends might seem boring. But going back to the basics is how I beat the dot-com bust from 2000 to 2003.

And so far, it’s working for me again. Consider this approach today.

Good investing,

Marc Gerstein