No matter your investing goals, I’m sure you love income-generating ideas…

After all, who doesn’t want more income?

You can reinvest the extra income in the original investment to compound your gains. Or you can take it and diversify into other opportunities.

But I bet the last place you would look for an income-generating idea is the tech space…

Tech companies don’t pay a lot of dividends – or income – in general. Instead, they like to put any extra money back into their research and development efforts.

Their stocks thrive on future growth potential. So this type of strategy makes sense for them.

But as I’ll show you today, one tech-focused exchange-traded fund (“ETF”) is set up to provide folks with steady income during volatile times. That’s important in the current environment.

And even better, the Power Gauge just alerted us to a critical change in its setup…

I’m talking about the Global X Nasdaq 100 Covered Call Fund (QYLD).

This ETF debuted about a decade ago. And with more than $6 billion in assets under management, QYLD is far from a secret to investors.

The most interesting part is the ETF’s yield. I had to check it twice myself…

QYLD yields more than 12% right now!

You might not think that’s possible with a tech-heavy ETF. But here’s how it works…

In short, QYLD is a covered-call strategy in an ETF wrapper.

It owns all the stocks in the tech-heavy Nasdaq 100 Index. And it sells one-month-forward calls on the index to produce monthly income.

Also, index options can’t get exercised early. So that gives QYLD’s buyers an extra level of protection.

That brings us to why QYLD is attractive today…

Tech is in high demand right now. And that’s driving options premiums higher.

When expectations are high for future stock-price gains, premiums rise. It’s that simple.

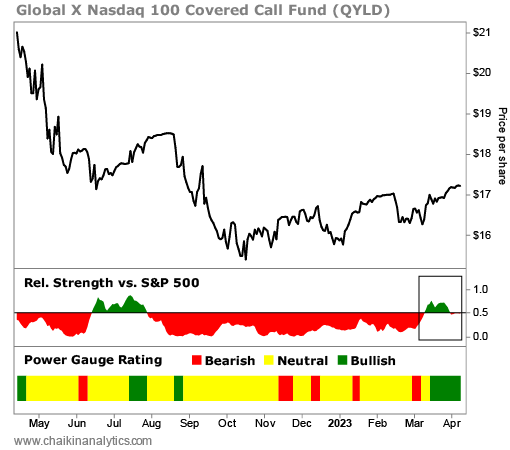

Even better, the Power Gauge sees the opportunity in QYLD right now. The system recently flipped to “bullish” on this ETF. And its relative strength just turned positive as well…

When relative strength flips to positive, it tells us the ETF (or stock) is in high demand. That tells us it’s worth paying attention to – and that’s the case with QYLD today.

In the end, QYLD could be a great parking lot for a small portion of your investment money right now. But please note that it’s a short-term solution. Don’t just set it and forget it.

Options-based ETFs like QYLD thrive during volatile times. And no one knows how long that volatility might last…

The current sentiment in the market is that the Federal Reserve won’t keep raising interest rates much longer. That’s good news for tech stocks – and in turn, it’s good news for QYLD.

Remember, yield and price are inversely related. So investors can expect the ETF’s share price to climb as its yield drops.

Consider taking advantage of this opportunity today.

Good investing,

Pete Carmasino