Like many Baby Boomers, I still mourn the Beatles’ breakup…

Among other things, George Harrison hated the group’s grueling tour schedule. But Paul McCartney loved playing in jam-packed venues at the height of the “Beatlemania” craze.

Harrison also wanted to compose more of his own music for the group. However, McCartney and John Lennon rejected many of his song ideas.

Finally, in April 1970, McCartney announced that he would stop working as part of the Beatles. The group’s four members never worked together at the same time again.

But that doesn’t mean they didn’t thrive on their own. That’s especially true of McCartney, who launched a successful solo career. He’s still touring more than 50 years later.

Today, a Beatles-like breakup is going on in the market. And as you’ll see, two members of this popular group of stocks are on very different paths right now…

The Beatles-like group that I’m talking about is the so-called “FANG” stocks. Financial-TV analysts, including CNBC’s Jim Cramer, popularized the term about a decade ago.

At the time, FANG stood for Facebook, Amazon (AMZN), Netflix (NFLX), and Google.

But over the years, marketing folks and company “visionaries” messed with the acronym. Nowadays, it’s Meta Platforms (META), Amazon, Netflix, and Alphabet (GOOGL).

“MANA” just doesn’t roll off the tongue as well, though. So instead, most folks still use the FANG acronym. Or they include Apple (AAPL) in the tech-centric group and use “FAANG.”

Like the Beatles in 1970, two FANG stocks are going their separate ways today…

It started with Netflix back in January. The company quietly admitted in its earnings report that competition was hurting its growth. As a result, the stock fell about 22% in one day.

Then, in February, Meta Platforms reported a modest decline in users. That isn’t supposed to happen with a FANG company. So its stock plunged 26%.

In April, Netflix again shocked Wall Street. Its earnings report showed big customer losses. It hadn’t lost subscribers in more than a decade. So in turn, its stock fell 35%.

After that, Netflix and Meta Platforms diverged like McCartney and Harrison…

Netflix quickly acknowledged some big problems.

The company has known forever that many users share passwords instead of getting their own accounts. It has been working to fix that. And now, it might have a solution…

In short, the company plans to charge an “extra member” fee for each profile that isn’t part of a premium user’s household. And related to that, a new feature will allow folks to transfer their recommendations from a shared Netflix account to a new, independent account.

Netflix also recognized that many folks didn’t want to pay high fees for its service. So it’s now introducing a lower-priced subscription tier as long as folks watch ads along the way.

In short, Netflix is being proactive as this FANG breakup plays out.

The Power Gauge sees that, too. It’s now “bullish” on Netflix. And there’s more…

My colleague Pete Carmasino discussed relative strength in his October 21 essay.

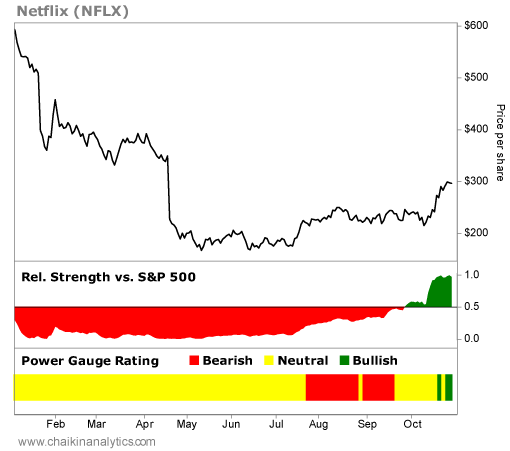

And as you can see in the chart below, that indicator just transitioned to “bullish” for Netflix at about the same time as its overall Power Gauge rating flipped to “bullish.” Take a look…

A near-simultaneous improvement in the overall Power Gauge rating and the relative strength indicator is known as a “bullish personality change.” That’s a great setup.

On the other hand, Meta Platforms continues to struggle. The company reported another quarter of disappointing results last week. It cited heavy spending and weak prices for ads.

When customer counts and revenues are careening lower, most companies look to cut costs – or at least moderate them. But Meta Platforms is being stubborn…

The company plans to spend between $85 billion and $87 billion this year to build the “metaverse” (essentially, an immersive virtual world). And instead of cutting costs, it plans to boost them to between $96 billion and $101 billion in 2023.

The relative strength indicator has been persistently dreadful for Meta Platforms.

Also, look at the Chaikin Money Flow indicator. Remember, this indicator tells us what the “smart money” is doing. These investors are clearly fleeing Meta Platforms. Take a look…

When it comes to these two FANG stocks, the takeaway is clear…

Netflix hit hard times. And it’s now taking steps to turn things around. But when Meta Platforms ran into trouble, it did the opposite. It’s doubling down and increasing costs.

Baby Boomers like me learned long ago that life carried on after the Beatles broke up. McCartney and Harrison did just fine on their own. They both had successful solo careers.

It’s time for investors to follow suit with the FANG stocks…

Don’t blindly lump these stocks together based on their old group. Instead, take the time to analyze them independently. You’ll see that some of them are stronger than others.

Good investing,

Marc Gerstein