If you still have a vintage 1970s “WIN” button, you might be able to cash in today…

The buttons were part of a grassroots effort to fight soaring inflation at the time. WIN stands for “Whip Inflation Now.”

Officials hoped to raise awareness with the WIN buttons. The idea was that individuals should save more and cut spending… And if they could, that would cure inflation.

Of course, wearing WIN buttons didn’t help investors (or anyone) in the 1970s. Nor will it help now that inflation has returned to our daily lives after a generational hiatus.

I’m no more able to solve inflation today than former President Gerald Ford was back then. But as you’ll see, I do have an idea that can help your portfolio cope with inflation…

It’s the Fidelity Stocks for Inflation Fund (FCPI).

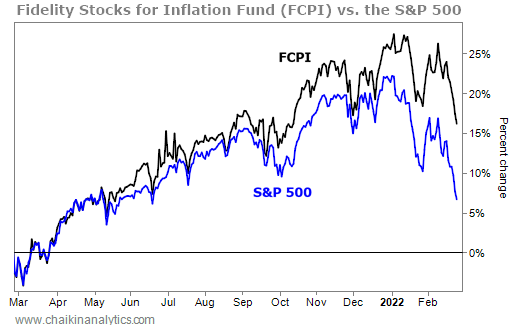

Right now, our Power Gauge system rates this exchange-traded fund (“ETF”) as “very bullish.” And as you can see, it’s more than doubling the S&P 500 Index in the past year…

Importantly, FCPI is a one-stop shop for four solid inflation-fighting strategies…

First, it helps us to be wary of bonds. These assets are more formally known as “fixed-income securities.” The danger, in times of inflation, comes from the word “fixed”…

When interest rates rise, yields on existing bonds must also rise. Nobody will buy a bond with a 2% yield in the secondary market if a newly issued bond yields 3%.

But we can’t just raise existing bonds’ interest payments to get the yield to 3%. The interest payments are contractually “fixed.” So the only thing Mr. Market can do is lower the price.

FCPI implements this strategy by avoiding bonds. It only owns stocks.

Second, FCPI helps us own hard (or “real”) assets. By that, we mean precious metals, industrial metals, oil, agricultural commodities, real estate, and so forth.

Nearly 25% of FCPI’s portfolio is invested in hard-asset companies in the energy, materials, and real estate sectors. So this ETF is a great way to implement this strategy as well.

Third, FCPI allows us to invest in companies capable of keeping up with inflation by raising prices.

The companies best suited to do that have some sort of unique competitive advantage. It can be a distinct technology… or a desirable brand. No matter what the advantage is, it usually translates into strong returns on equity.

Roughly 40% of FCPI’s portfolio is in technology and health care companies that depend on intellectual property (“IP”). And another 18% is in consumer-oriented companies, many of which rely heavily on strong brands.

Some tech and health care companies are more IP-oriented than others. And some consumer brands are stronger than others.

That’s why strong return on equity is key. It’s one important clue to the presence of the sort of competitive edge that would allow companies to raise prices.

The median return on equity for stocks in FCPI’s portfolio is 28.2% right now. That’s nearly double the S&P 500’s current median return on equity of 14.3%.

And finally, FCPI helps us to avoid extremely high stock-valuation ratios.

Even though strong growth prospects can justify high valuations, inflation – and the rising interest rates it causes – adds another wrinkle for investors…

High-valuation growth stocks are priced on the basis of earnings expected to be reported many years from now. These future stock values need to be converted into “present values” by applying a “discount rate” to the future earnings.

When inflation increases and causes interest rates to rise, the discount rates go up, too. When that happens, the “present value” of the future earnings (today’s price) falls.

FCPI stays out of this kind of trouble…

Using estimated 2023 earnings per share, the median price-to-earnings (“P/E”) ratio of stocks in FCPI’s portfolio is 11.9. The median P/E ratio for the S&P 500 is 17.3.

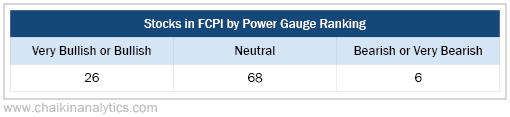

The bottom line is… FCPI’s inflation-fighting characteristics result in an excellent “Power Bar” ratio. That’s our portfolio-weighted breakdown of “bullish” versus “bearish” stocks within the ETF…

When you add everything up, FCPI is a great way to fight inflation without a WIN button.

Good investing

Marc Gerstein