Last Saturday, the Rose and Crown warned its patrons about the energy crisis in Europe…

The pub in Bebington, England posted a screenshot of an electricity estimate on Twitter.

Fortunately, the Rose and Crown entered a contract for its electricity price until May 2023. So for the next eight months or so, it will pay 37 pence per unit. (That’s about 43 cents.)

But that’s already a significant hike from the 15 pence per unit the pub paid this past May. And now, the best available quote from British Gas going forward is 97 pence per unit.

Even under the best deal, the Rose and Crown’s costs are set to surge 546% year over year.

Under the estimate, the pub’s annual electricity bill would jump to £61,667.94 (roughly $72,000). Think about that… This is a local pub. It doesn’t use a ton of electricity.

I worry about these small business owners and their workers amid Europe’s energy woes. And unfortunately, it’s a drop in the bucket of what could happen in the months ahead…

Big corporations are at risk, too. And this story is playing out all over Europe.

Let me explain…

Energy prices in France recently exceeded 1,100 euros per megawatt-hour (“MWh”). And they reached 995 euros per MWh in Germany. In both cases, it’s an increase of more than 10 times over the past year.

To put that in perspective, the average electricity cost in the U.S. is $154 per MWh. (Right now, the euro-to-dollar exchange rate is roughly even. So that’s about 154 euros, too.)

Plain and simple… the energy crisis is hurting European consumers. It’s making business hard for companies. And in turn, the stocks in this region are suffering.

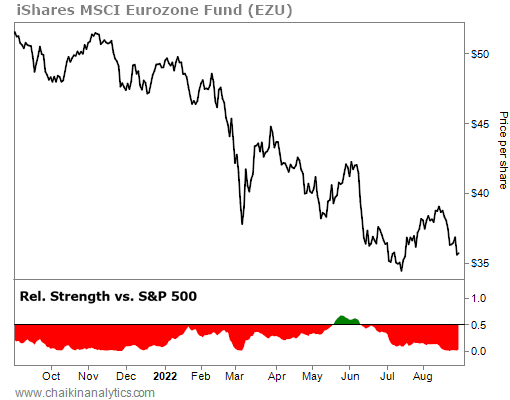

Just look at the one-year chart of the iShares MSCI Eurozone Fund (EZU)…

EZU is already down more than 30% since last November. It has underperformed the broader market for most of the past year. And the Power Gauge rates it as “very bearish” right now.

Europe put itself in handcuffs…

The region depends on fuel from outside sources. Now, the prospects of both war and civil unrest are on its doorstep. And that lack of foresight is proving costly for innocent residents.

To battle the shortage, European countries are raising their fuel-storage levels as fast as they can. But unfortunately, prices spiked because of the buying surge.

So now, governments across the region are introducing price caps. That means they’ll need to subsidize the power companies. Intentional “brownouts” and actual electricity lockdowns are on the table, too.

As we’ve discussed before, Russia is playing a dangerous game…

It’s cutting natural gas supplies to Europe. And that’s causing natural gas prices to soar. They recently hit a high of 341 euros per MWh. That’s near the all-time high of 345 euros per MWh – which was just set in March.

Folks, this is a terrible mess…

Europe is on the brink of a major recession – and perhaps even a depression. And I don’t think I’m exaggerating too much when I say it’s a “doomsday” scenario.

EZU’s price chart shows you that it’s best to avoid European stocks today.

On the flip side, energy has been the market’s best-performing sector in 2022. The sector is up more than 46% so far this year.

And keep in mind… energy currently makes up less than 5% of the S&P 500 Index.

So being overweight this sector in your portfolio is wise. If the ongoing crisis in Europe is any indication, it’s going to be a long winter.

Good investing,

Pete Carmasino