The U.S. government can’t borrow any more money…

Not yet, at least.

You see, as a country, we’ve hit our $31.4 trillion “debt ceiling.” That’s the most money the U.S. can owe at any time. And it works out to roughly $94,000 per citizen today.

The U.S. could default on its debt as soon as this summer if Congress can’t come to terms on what to do next. That could destroy the economy…

The government wouldn’t be able to pay federal employees, contractors, and suppliers. And it couldn’t make any payments on existing debt – including interest on the U.S. Treasury bonds in the world today.

But here’s why I wouldn’t worry just yet…

As scary as all this debt-ceiling stuff sounds, we’ve been here before…

Many times.

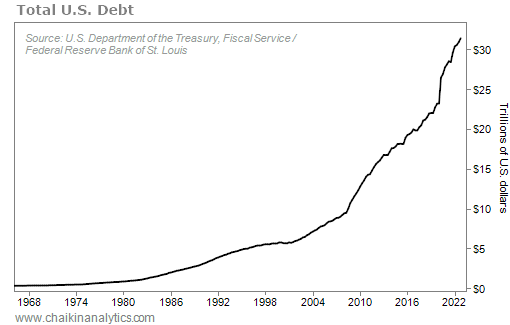

I’m sure you’ve seen or heard about the debt ceiling in the news in recent years. But I’m not sure you realize how much total U.S. debt has surged. Take a look…

It’s a seemingly never-ending trend. It has gone “up and to the right” for many decades.

As debt surges higher, the U.S. government can choose one of three options…

- Cut spending

- Increase economic efficiency and output

- Raise the debt ceiling and borrow more money

The first option is a political nonstarter – especially as we near the next election cycle. And the second option is big, complicated, and would take years (perhaps even decades).

Considering that, I don’t need to tell you which option the government always picks…

Every time we’ve been in this position before, Congress has raised the debt ceiling.

In fact, between 2001 and 2016 alone, the government raised the debt ceiling 14 times. That’s almost once per year.

It’s nothing more than “kicking the can down the road.”

At the end of the day, simply making it the next guy’s problem isn’t a real solution. We need to cut spending and improve economic output to reduce our massive national-debt burden.

But that’s easier said than done. And it’s especially hard to do when the decision-makers in Washington, D.C. can simply sign their names and approve trillions more in new spending.

So in the end… we should expect another debt-ceiling increase this time.

That means it’s “business as usual” for the U.S. government and the economy.

After all, the alternative is a true default. That would devastate the U.S. economy – and likely spread throughout much of the world.

Instead, the U.S. government will continue to finance its operations the same way it has for decades. It will keep borrowing more from its citizens and other countries.

You’ll likely see a lot of news about the debt ceiling in the coming days. But for investors like us, the main idea is clear…

Our elected leaders likely won’t do anything other than what they always do.

They’ll kick the debt can down the road once again.

Good investing,

Briton Hill