Kelly really likes Jim… So she asks Jim’s friend out in an effort to get his attention.

Ralf wants a new bike. He won’t stop talking about a shiny red one. It’s perfect for him… But when Ralf gets to the store, he buys a used green bike because it was on sale.

Charles sees a certain market sector is soaring. If he just puts his money to work in that space, he’s sure to make a fortune… But when it comes time to buy, he instead finds a convoluted “backdoor strategy” for buying into the sector.

Folks, I’m sure you know what I’m talking about…

People want one thing. But in their pursuit of that one thing, they often do something else.

Now, I don’t know what you call this type of behavior. Coming up, I always heard it described as “getting cute”…

“Getting cute” is the act of taking something simple and making it complicated. You could also describe it as “trying to outsmart the problem.”

This behavior is maddening. And it’s particularly dangerous in investing. But through some quirk of human psychology, we’re all guilty of doing it at one time or another.

Well folks, I want to make this clear…

Energy stocks are soaring. And maybe you’re tempted to look for a fancy way to play the trend. But as I’ll show you today, now is not the time for getting cute in this space…

I’m sure you’ve seen gas prices hitting record highs.

Heck, the average cost for a gallon of gas is more than $6.15 in California. And even on the low side, in states like Kansas and Georgia, it’s still at roughly $4.20 per gallon.

Energy is simply the hottest sector in the market right now.

So if you’re an astute investor, you’re likely looking to take advantage of that uptrend. And maybe you’ve spent time trying to find the perfect way to play it.

Well, I’m here to tell you today… You don’t need to get cute with energy stocks.

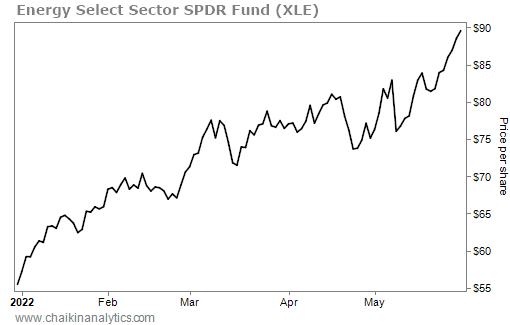

You’ll do well if you simply invest in the broad sector itself. Take a look…

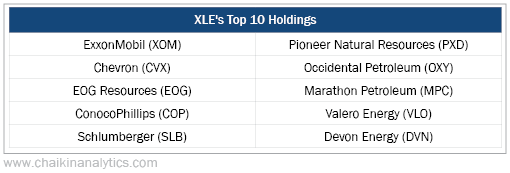

This chart shows the Energy Select Sector SPDR Fund (XLE). This exchange-traded fund (“ETF”) holds many of the world’s most recognizable oil and gas companies…

Now, as you can see in the above chart, XLE is up about 60% so far this year. That’s outstanding for a five-month span. Any investor should be happy with that type of return.

That’s especially true given the broad market’s struggles in 2022…

Remember, as we’ve discussed recently, the S&P 500 Index is down roughly 13% this year. And the tech-heavy Nasdaq is down around 23% over the same span.

So… you could try “getting cute” with energy stocks. You could try to find a “better way” to profit from this uptrend. But don’t make investing harder than it needs to be…

If you’re optimistic about energy stocks, why not just buy the ETF that holds the biggest names and is already soaring?

The future looks bright for energy stocks, too. XLE earns a “very bullish” rating from the Power Gauge. And the system doesn’t rate any of the stocks in the ETF as “bearish” today.

Could other energy opportunities outperform XLE? Absolutely. And in our paid publications, we use the Power Gauge to help us track down those opportunities.

But if you’re sitting on the sidelines, trying to find the perfect way to play the energy sector… stop.

You don’t need to get cute with energy stocks. The answer is right in front of you.

Good investing,

Carlton Neel