The Federal Reserve is raising interest rates… And that’s causing bond prices to fall.

Bonds are supposed to produce consistent, low-risk returns. That’s why they’re popular with retirees. Many of these folks use this steady stream of income to support themselves.

So with bond prices dropping today, I can see why a lot of retirees might be a little uneasy.

No one likes to see their savings go down. And that’s especially true for retirees.

But in reality, it shouldn’t matter if bond prices go down while you’re holding them. That’s because bonds work differently than stocks…

You see, with bonds, you give your money to the issuer up front. In exchange, the issuer promises to pay you a “coupon” – or interest – along the way. Then, at the end of your agreed-upon term with the issuer, you get all of your money back.

The problem is… most folks don’t buy actual bonds these days. Instead, they make their bond investments through proxies – or what I like to call “pseudo bonds.”

Now, as you’ll see, these pseudo bonds are similar to actual bonds in many ways. After all, they do hold a basket of actual bonds. And they do offer investors a way to collect income.

But the way they work isn’t exactly like actual bonds.

In times like today, that difference is really dramatic for investors. And if you plan to retire anytime soon, you need to understand this difference…

The issue is simple…

The price that folks are willing to pay for a bond changes over its lifetime. It can vary based on supply and demand, as well as interest rates. And right now, bond prices are falling.

But remember… if you hold a bond until maturity, the price along the way doesn’t matter. You’ll still get your interest payments. And you’ll still get your money back at the end.

In short, if you never plan on selling something, its price at any point isn’t important. In the case of bonds, you still get what you want without selling – steady income.

However, as I said earlier, many folks don’t invest in actual bonds anymore…

You see, most people take the easy way out. They get their bond exposure from “one click” exchange-traded funds (“ETFs”) – like the iShares 20+ Year Treasury Bond Fund (TLT).

In short, TLT invests in long-term U.S. Treasury bonds. As its name implies, its holdings cover 20 years or longer. And right now, folks have invested roughly $19 billion in this ETF.

But the thing is, bond ETFs like TLT don’t hold their bonds to maturity. They rebalance to control their risk exposure, which means that they buy and sell bonds along the way.

That’s why I like to call them “pseudo bonds.”

Here’s the important point… In a market where bond prices are falling – like today – it means these ETFs are losing money.

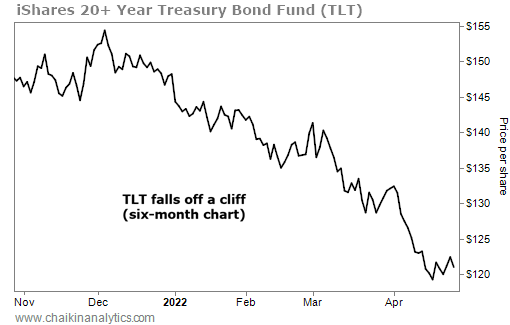

Just look at what’s happening to TLT right now…

As you can see, TLT’s market value is down around 21% from its peak in early December. That’s much worse than the benchmark S&P 500 Index’s roughly 7% decline over that span.

These ETFs can sometimes pay off for investors, of course. They don’t always go down.

But the bottom line is… these pseudo bonds simply don’t always perform like actual bonds.

If you want exposure to bonds, it’s often worth the extra effort to invest directly in them.

However, if that sounds daunting, don’t worry… My colleague Marc Gerstein will discuss another option with you tomorrow. You won’t want to miss it.

Good investing,

Karina Kovalcik