If you’re confused about the market right now… good.

That means you’re paying attention. After all, the world is full of mixed signals…

Has inflation peaked or do we still need to fight hard against it?

Is the economy improving or is the Federal Reserve driving us into a deep recession?

Is Western Europe heading for an energy crisis or will it figure things out?

If you look around, you’ll find headlines to support all these views – and more.

So as an investor, it can be hard to figure out what to do…

Of course, our goal is to reduce risk during uncertain times like today. But at the same time, we don’t want to put too much of our money on the sidelines in case the market rallies.

The Power Gauge can help us rotate from one sector or investing style to another. But the market’s wheels are turning faster these days… So that might require a more active approach than you want.

Fortunately, conservative investors can do one thing to navigate these rough waters.

Let me explain…

In short, you could consider the Invesco S&P 500 Equal Weight Fund (RSP).

This exchange-traded fund (“ETF”) holds the same large, generally high-quality companies as the better-known SPDR S&P 500 Trust (SPY). It includes all the S&P 500 components.

But importantly, RSP’s positions aren’t weighted by market cap like SPY…

For example, the biggest S&P 500 component is Apple (AAPL). Its market cap is around $2.5 trillion. And with a market cap of about $3.7 billion, clothing maker PVH (PVH) is the smallest.

Apple accounts for roughly 7.1% of SPY. And PVH is only about 0.01%. (Yes, seriously!)

It’s a different story with RSP…

Every holding makes up roughly 0.2% of the ETF. That allocation can sometimes get out of whack as daily trading occurs. But the ETF rebalances every quarter to about 0.2%.

And as I’ve discussed before, these weighting protocols are a big deal…

Market-cap weighting, like SPY, has been around for ages. But lately, investors have fallen deeper in love with the biggest, most glamorous boom-and-bust stocks.

Now, “boom and bust” doesn’t refer to the companies themselves. They’re all stable giants. Rather, it’s about their stocks – which gyrate heavily as valuation expands and shrinks.

So with more investors taking this type of approach in recent years, glamorous stocks like Apple, Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), and Tesla (TSLA) are hogging up more of SPY’s portfolio. Today, their combined weighting is roughly 22%.

In other words… nearly a quarter of an ETF with 500-plus holdings is tied up in five stocks.

That’s a big deal when it comes to performance…

For much of the past decade, the S&P 500 soared. And the glamorous stocks led the charge. As a result, the market-cap-weighted SPY outperformed the equal-weighted RSP.

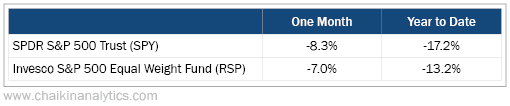

But during challenging times, the story plays out differently. Take a look…

As you can see, RSP is down roughly 13% so far in 2022. However, that’s better than SPY’s more than 17% loss over the same period.

Nobody ever wants to lose money. But if you stick with SPY and the market’s slide continues, you’ll likely be much worse off than if you put your money in RSP.

In turbulent times like today, risk management is key. And RSP helps us do that.

We’re not aggressively biased to the boom-and-bust stocks.

But at the same time, we’re not putting all of our money on the sidelines. That way, we’ll still benefit if the market rallies from here.

It’s the perfect way to stay invested with less risk.

Good investing,

Marc Gerstein