In 2019, the Wall Street Journal noted that “hating the Fed is as American as apple pie.”

That’s undoubtedly still true today…

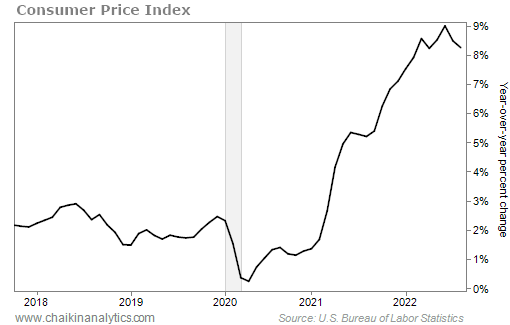

Inflation spiraled out of control in the wake of the COVID-19 pandemic and recovery. It’s now consistently in the 8% to 9% range. It hasn’t been that high since the early 1980s.

Many U.S. investors today have never seen anything like it. Heck, a lot of economists and Wall Street professionals weren’t even born the last time inflation was this high.

Meanwhile, the stock market is reeling. The S&P 500 Index remains deep into an official bear market. It’s down roughly 25% from its January peak.

Most of us have experienced steep market downturns before. But over the years, we got used to the Federal Reserve rescuing stocks by cutting interest rates.

Today, the Fed is doing the opposite. The federal funds rate is now above 3% and climbing. And it feels like the economy is sitting at the edge of a cliff…

We’re already in recession, technically speaking. Now, prognosticators are starting to talk about a meaningful downturn – one that really hurts and lasts for an extended period.

So I realize that what I’m about to say is hard to accept. But right now…

The Fed is getting it right.

I’m serious. And we have data to support that claim…

Today, we’ll look at one key measure that tells us better days are closer than you might think. And as you’ll see, it shows us the Fed could soon get the economy rolling again…

We’re currently facing what economists like to call “demand-pull inflation.” That simply means too many dollars are chasing too few goods.

Importantly, foolish policy didn’t cause this phenomenon. It was the outcome of our response to the COVID-19 pandemic.

The economy didn’t merely slow. Major portions of it were deliberately closed.

The first round of scarcity came from the shutdown itself. And then, the erratic reopening of the economy and supply chains led to the next phase of scarcity.

Now, we’re dealing with the pragmatic side of this phenomenon…

It took time to recognize that the scarcity wouldn’t immediately vanish after the pandemic. But as that reality came into focus… so did the painful reality of out-of-control inflation.

The Fed had no choice.

It needs to bring the money supply back in line with the supply of goods and services. That’s the only way to cure demand-pull inflation. And higher interest rates (a higher price for money) is the inevitable result of lesser supply.

But as painful as this approach is… it’s working.

Year-over-year growth in the Consumer Price Index (“CPI”) is already dropping. Take a look…

If that were a stock’s price chart, we would describe it as being “toppy.” We would say the stock is encountering resistance and would likely fall moving forward.

And of course, when it comes to inflation… that’s exactly what we want.

It’s the start of a major shift. And it’s happening because the Fed has been raising rates.

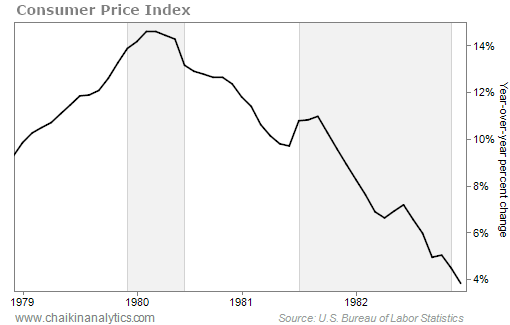

Here’s how the complete transition looked from 1979 through 1982…

Today’s experience looks a lot like 1980. But we’re starting from a lower peak this time.

With that said, we’re not totally out of the woods yet…

A lot more pain could still occur. Looking back to the above chart of the early 1980s, you can see what I mean with the shaded (recessionary) part. It lasted for more than a year.

But importantly, the Fed is following a sound playbook. And it’s working.

So don’t panic. Instead, I’ll repeat what I said on September 29…

Prepare for better days by monitoring cyclical stocks.

Investing in stocks that are clearly breaking past current headwinds. And be ready to jump quickly into other great opportunities as the Fed’s plan continues to play out.

Good investing,

Marc Gerstein