Folks, we’ve survived another wild month in the markets…

The S&P 500 Index gained roughly 9% in July. It was the benchmark index’s best month since November 2020.

Despite that, we’re not fully out of the woods yet…

The S&P 500 is still down roughly 12% since late March. And it’s still down about 15% from its all-time high on the first trading day in 2022.

With that said, the beginning of a transition in this downturn is taking place. Specifically, I’m talking about a more defined sector rotation…

It’s happening in health care and biotech. And it means Wall Street is transitioning its strategy from general fear to strategic allocation.

That’s good news for us…

Put simply, the market is starting to “figure out” the challenge it’s facing. When that happens, the challenge remains… but it enables us to make tactical decisions.

So today, let’s take a closer look at this shift. And importantly, I’ll reveal where our Power Gauge system says you should focus your attention right now…

We’ll start at the top with a sector-based look at the market…

The Health Care Select Sector SPDR Fund (XLV) is near the top of the Power Gauge’s rankings. Right now, 22 of its holdings receive “bullish” or better overall ratings. And it’s one of four sector-focused exchange-traded funds (“ETFs”) in “very bullish” range today.

When we drill down into the subsector level, we find the real meat of this story…

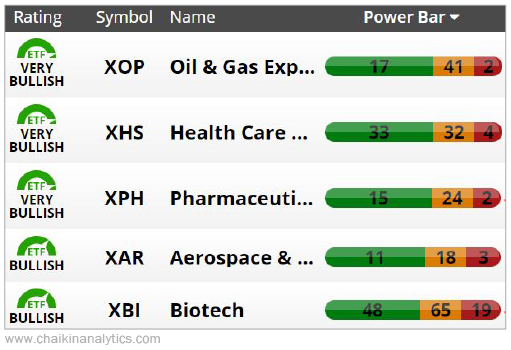

Notice that three of the top five subsectors today are health care services, pharmaceuticals, and biotech. These three subsector ETFs all have “bullish” or better ratings.

The Power Gauge turned “very bullish” on the SPDR S&P Pharmaceuticals Fund (XPH) on June 21. And it flipped to its “very bullish” and “bullish” ratings, respectively, for the SPDR S&P Health Care Services Fund (XHS) and the SPDR S&P Biotech Fund (XBI) on July 5.

The biotech subsector came roaring back to life in recent weeks. And with the Power Gauge’s help, we can see that this corner of the market looks primed to be the next big winner.

In fact, the turnaround is already underway. Look at the performance of those three health care ETFs since February…

Notice the consistent “W” bottom across all three ETFs. They all bottomed at two different points in mid-May and mid-June.

Now, look at the progression of “higher lows” since mid-June. That’s a positive development. It’s when the turnaround began.

In a serious downturn like the one we’re in… that’s the kind of signal we want to see.

Thankfully, the market has clearly defined it for us.

Now, stocks will still likely face significant hurdles in the coming months…

The Federal Reserve is pumping up interest rates. In turn, that makes the cost of doing business higher. Consumers still face near-record levels of inflation. And worse still, the strength of the U.S. dollar is making it harder for U.S.-based businesses to profit overseas.

So prepare for more volatility in the coming months.

But I’m optimistic that the market is now transitioning to a “tactical bear” phase as well. And biotech, health care, and pharma stocks are leading the way.

Wall Street will logically place its chips on the table. And that will lead to big opportunities for us.

Good investing,

Marc Chaikin