When a multibillion-dollar company starts to change trend… I take notice.

You should, too…

This company’s market cap is roughly $31 billion today. It does more than $10 billion in sales each year.

It’s in a life-changing business as well. It makes a handful of drugs that treat neurological diseases. And more than half its revenue comes from drugs that treat multiple sclerosis.

But like most of the market, this stock has been punished. It’s down about 50% since it briefly surged to more than $400 per share in June 2021. It’s at about $214 per share today.

That’s a major drop.

However, in this essay, I’ll show you why this stock is worth watching right now…

The company I’m talking about is global biotech giant Biogen (BIIB).

Let’s start with the Power Gauge’s current breakdown of Biogen. The four main factor categories tell a story here…

A “very bullish” outlook in Financials and a “bullish” grade in the Experts category help to shape the overall “bullish” narrative. But to me, the rating is the icing on the cake.

In this case, the real “tell” is the technical change on the relative strength indicator…

Right now, our relative strength indicator is changing trend to the upside. That means Biogen is now outperforming the SPDR S&P 500 Fund (SPY). Take a look…

This chart is one of the best setups the market can deliver…

You can see that Biogen’s stock has slowly grinded lower for the past 12 months. And now, the setup we’re seeing here is something that typically happens before a big move higher.

Let me show you what I mean with another example…

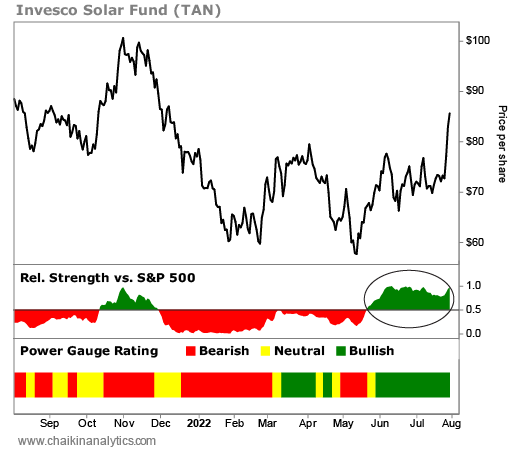

Recently, the renewable-energy sector experienced a trend change. That led me to the Invesco Solar Fund (TAN), which was setting up with the same pattern. Take a look…

Look at the period between May and June on the chart…

Notice that the relative strength indicator started to turn green. The Power Gauge also flipped to “bullish” at the time. And the share price was very stable in a declining market.

That means it was building up “buying” pressure. This opportunity had all the makings of a breakout…

- The relative strength indicator turned positive

- The stock’s Power Gauge rating flipped to “bullish”

- The industry is front and center again due to the world’s energy issues

As I’ve said in the past, technical indicators tell you “when”… And the “why” will show up later.

Over the past seven weeks, TAN is up roughly 24%. That’s an annualized return of more than 200%.

Inexperienced investors might not have given TAN a second look. But market pros are constantly searching for these types of clues. And so should you…

It’s essential to understand that relative strength is the key to bigger gains.

Relative strength sometimes starts slow, like it did in TAN’s case. But it can quickly become a powerful indicator. It can be an early signal to something important for investors.

That’s what we’re seeing with Biogen today…

The stock is setting up with this exact same relative strength pattern.

The weight of the evidence is on your side. Add this opportunity to your watch list today.

Good investing,

Pete Carmasino