Folks, something is wrong in the world of exchange-traded funds (ETFs)…

I bet you already knowabout it. But you likely have no idea that it’s even a problem.

You see, the issue is a little wonky to begin with. And ETF providers disclose the problem so often and in such a routine way that you probably gloss right over it.

So it’s no wonder that most folks just take for granted these days that “this is the way it is.”

But as I’ll explain today, this assumption can swing your portfolio in a big way…

I’m talking about market cap-weighted ETFs and indexes.

It simply means that the biggest stocks make up the biggest portions. That’s how the ubiquitous S&P 500 Index is calculated. A multitude of issuers build their ETFs this way, too.

But that’s a lot different from how many people intuitively think about stocks.

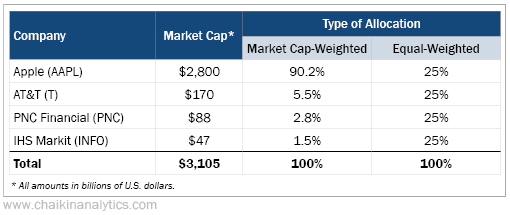

The following table shows two portfolios. One is market cap-weighted like many ETFs. And the other is equal-weighted – meaning everything is the same allocation. Take a look…

Suppose Apple falls 10% in a month while the other three stocks don’t move at all…

The market cap-weighted portfolio would drop 9% overall (a 10% loss for 90% of the portfolio). Meanwhile, the equal-weighted portfolio would only drop 2.5% (a 10% loss for 25% of the portfolio).

This is an extreme example. I wanted to make it easy to see. But the thing is, this problem crops up in real life, too…

Apple, Microsoft (MSFT), and Amazon (AMZN) make up more than 16% of the S&P 500-tracking SPDR S&P 500 Trust (SPY) today. So when these companies get hit hard, this market cap-weighted ETF gets hit hard, too.

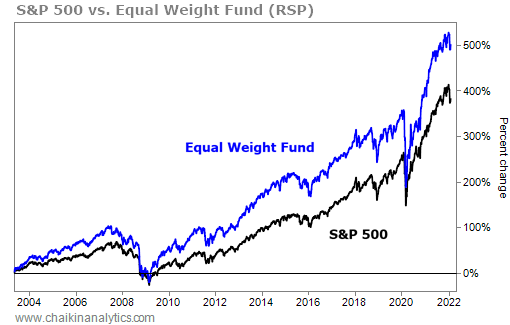

Of course, over the past five years, these big-name, high-flying tech stocks powered the ETF higher… It has outperformed one of its equal-weight cousins, the Invesco S&P 500 Equal Weight Fund (RSP), by about 20 percentage points over that span

But importantly, this period has been an exception…

Over the longer term, the equal-weight ETF has outperformed the market cap-weighted ETF in a big way. Here’s a comparison of the two ETFs since RSP launched in April 2003…

As you can see, over the past 19 years, RSP is up around 510%. Meanwhile, the S&P 500 is only up about 390% in that span. The small, short-term differences add up!

Looking to the future, if stocks falter, expect market cap weighting to make things worse than equal weighting would. The big-name, high-flying tech stocks would likely suffer the most. And they would drag the market cap-weighted indexes and ETFs down, too.

It just comes down to basic math. When overpriced stocks with large weightings fall, that’s what happens. It isn’t too noticeable from day to day, but it adds up over time.

Consider switching from SPY to RSP today. It’s an easy way to trim some risk out of your portfolio. And over the long haul, it’s likely to lead to outperformance as well.

Good investing,

Marc Gerstein