Disney’s (DIS) latest thriller isn’t playing in theaters…

Rather, it’s happening in the corporate suites. And two guys named Bob are the stars…

Bob Iger served as Disney’s CEO from 2005 until his contract expired in 2020.

Before stepping down, Iger hand-picked Bob Chapek as his replacement. And Iger stayed on as the company’s executive chairman through his retirement at the end of 2021.

The two men endured a rocky relationship throughout Chapek’s tenure as CEO…

Iger and Chapek collided on business strategies and leadership approaches, especially during the COVID-19 pandemic. And as they butted heads, Disney’s profits tanked…

Its normalized operating earnings per share peaked at $7.08 in the fiscal year that ended in September 2018. They fell to $5.77 in 2019 and to $2.02 in the pandemic-plagued 2020.

The drop into 2020 is understandable. After all, many companies suffered that year.

However, unlike most of these companies, Disney didn’t come roaring back as society reopened. The company’s normalized operating earnings per share remained depressed. They came in at $2.33 in 2021 and $3.53 in the year that ended in September.

And importantly, analysts don’t expect Disney’s earnings to surpass the old peak until 2026.

The company’s board of directors finally had enough. They dismissed Chapek and reinstated Iger as CEO this past November. And they’re giving him two years to turn things around.

But as I’ll explain today, the drama around this media giant is getting more complicated. A new power struggle is developing. And soon, it could change the company’s outlook…

Make no mistake, Disney is a world-class entertainment-content creator. But in today’s competitive environment… creative projects don’t automatically translate into profits.

Disney’s big TV networks include ABC, ESPN, National Geographic, and FX. And they’ve been suffering for a while. That’s because a lot of folks have “cut the cord” on cable.

So Disney has leveraged its strong brand to gain customers in the “streaming” space…

When Disney+ launched in November 2019, it attracted 10 million subscribers on the first day alone. And by this past October, it had reached 164.2 million global subscribers.

But the streaming landscape is spectacularly competitive…

Even though Disney+ boasts a powerful child-oriented brand and a decadeslong movie library, it hasn’t been able to keep up with rivals like Netflix (NFLX). In fact, Disney’s streaming division reported a roughly $1.5 billion loss in the fourth quarter of last year.

That poor performance caught the eye of activist investor Nelson Peltz…

Through his company Trian Fund Management, Peltz is pushing to “reinvigorat[e] the Disney ‘flywheel.'” And he wants to “ensur[e] customers get real value across all business lines.”

Iger and Peltz will likely keep jockeying for position in the months ahead.

Fortunately, we don’t need to take sides. We can simply follow the Power Gauge…

Regular PowerFeed readers are familiar with our one-of-a-kind system. It evaluates more than 5,000 stocks using 20 different factors in categories like Financials, Earnings, Experts, and Technicals. And ultimately, it helps us figure out the health of every stock at any time.

Today, Disney ranks as “neutral” overall. That makes sense… With all the drama at the company right now, it’s good to be careful as investors.

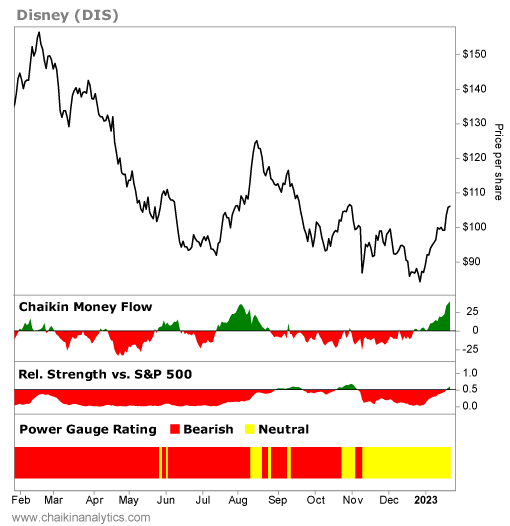

And frankly, Disney’s performance over the past year has been abysmal. The stock is down roughly 20%. That’s significantly worse than the broader market. Take a look…

But the thing is… we now have a reason to be optimistic about Disney’s future.

Look at the Chaikin Money Flow indicator in the lower panel of the chart…

This indicator tracks the movement of the so-called “smart money.” These institutional investors – such as pension funds, mutual funds, and hedge funds – are right more than they’re wrong. So in most cases, it’s good to invest in a stock alongside them.

Notice the strong recent inflows (marked in green) after months of outflows (marked in red). If that trend continues, it could soon lead Disney to a “bullish” Power Gauge rating.

In the latest part of this Disney thriller, we don’t need to root for Peltz. And we don’t need to side with Iger, either. We just need to follow the signals right in front of us…

Right now, the Power Gauge is “neutral” on Disney. So we’ll stay cautious.

But we’ll keep our eyes on the smart money. If these investors keep buying, we’ll consider following suit.

Good investing,

Marc Gerstein