Everyone wants to retire rich…

You’ve likely dreamed of the day when you can stop working. You’ll do whatever you want all day long. You’ll have no responsibilities. You can just relax by the pool or on the beach.

Of course, some of us are closer to retirement than others…

And in the case of today’s 20-somethings, it can be hard to see that far into the future. But one thing is certain… The sooner they start saving for it, the better off they’ll be.

In fact, that’s the case for everyone – no matter your age.

In short, a few years of savings can dramatically change the course of your retirement. And being careless about this critical topic is a sure-fire way to ruin all your dreams of leisure.

Let me show you what I mean with a hypothetical situation…

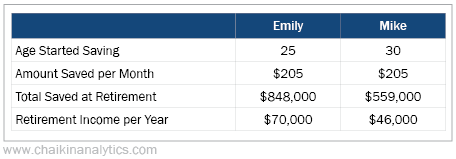

Emily and Mike have a lot in common. They’re both 25 years old, hold a steady job, and dream of success. And like most folks, they want to live comfortably after retiring at age 67.

Emily is more fortunate than Mike, though… Her mom is financially literate. She knows the power of what physicist Albert Einstein reportedly called the “eighth wonder of the world”…

Compound interest.

Put simply, it’s the concept of reinvesting your profits so your interest earns interest. That’s different from earning interest and pulling out your profits. And it’s much more powerful…

On Emily’s 25th birthday, she starts a retirement account. She contributes $205 each month until she retires at age 67. And she reinvests all the money she saves for retirement.

For this exercise, we’re assuming an 8% annual rate of return while Emily works and 5.5% while she’s retired.

Because Emily reinvests the money, when she retires, she’ll have about $848,000… That would work out to an annual income of $70,000 (or $5,833 per month) through age 87.

Emily likely will live happily ever after in a futuristic world of self-driving cars.

On the other hand, Mike isn’t so lucky… On his 30th birthday, he meets Emily and learns that she has been saving $205 each month. He decides to start saving that much, too.

However, here’s where the power of compound interest comes in…

When Mike retires at age 67, despite an identical rate of return, he only has $559,000. That’s much less than Emily… And it’s only about $46,000 per year through age 87.

The following table shows the full breakdown…

Here’s the important point…

You might not understand compounding gains if someone just talks about it. It’s sort of like someone telling you to eat your vegetables. But you’ll sure as heck understand it once you see that a late start can mean hundreds of thousands of dollars less at retirement…

Starting at age 25 allowed Emily to save much more than Mike, who didn’t start until age 30. This simple example led to a final difference of $289,000 – or $24,000 per year.

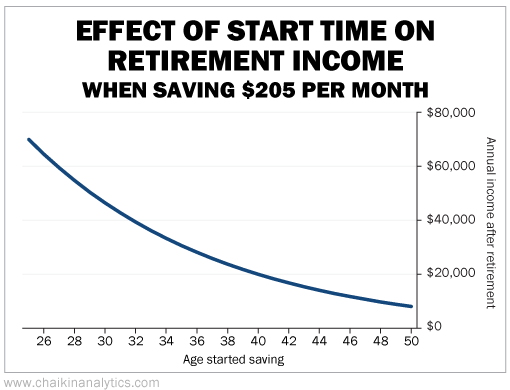

And this exercise isn’t just limited to 20-somethings. It works across all different ages. The earlier you start saving, the better. That’s true even if you’re older than Emily or Mike…

In the end, the takeaway is clear…

The power of compound interest always makes starting today better than tomorrow.

It only takes a few years to ruin your dreams. Now is the time to prepare for the future.

Good investing,

Karina Kovalcik