Do you want to invest in innovative and disruptive companies?

What if you could do that with an exchange-traded fund (“ETF”) using artificial intelligence (“AI”)?

You would probably want to know all about it. I know I sure would.

But now, imagine that the language used to describe the investment makes understanding it a little challenging, to say the least. It’s full of enough jargon to make your head spin.

Would you still be interested?

In today’s essay, I’ll share a real-life investment that fits this scenario. Importantly, you’ll see why you want the Power Gauge on your side when fancy buzzwords lead the charge…

I’m talking about the SPDR S&P Kensho New Economies Composite Fund (KOMP).

However, parsing through KOMP’s purpose can be confusing. Here’s what the ETF’s website says about the benchmark index it tracks…

The [S&P Kensho New Economies Composite] Index is designed to capture companies whose products and services are driving innovation and transforming the global economy through the use of existing and emerging technologies, and rapid developments in robotics, automation, artificial intelligence, connectedness and processing power (“New Economies companies”).

That’s a lot of jargon!

In short, the ETF buys high-tech stocks.

So how does it do that? Let’s go back to KOMP’s website…

Kensho identifies companies in its New Economy Subsectors using its propriety Natural Language Processing, which leverages their artificial intelligence capabilities to screen regulatory forms for key words and phrases in the appropriate context relevant to the respective new economy sector to find companies for inclusion.

Gee whiz. Is your head spinning yet?

The index operators use AI and language-processing software to look for the “disruptive” words that leading-edge companies include on their quarterly and annual filings with the U.S. Securities and Exchange Commission.

Now, KOMP isn’t a household name. You’ve probably never heard of it before. And I admit I hadn’t noticed it either before the Power Gauge brought it to my attention…

But that’s exactly why we use the Power Gauge.

The Power Gauge helps us uncover hidden, unique, and intriguing opportunities just like this one. It allows us to cut through all the jargon and confusing language.

And today, it’s “very bullish” on KOMP.

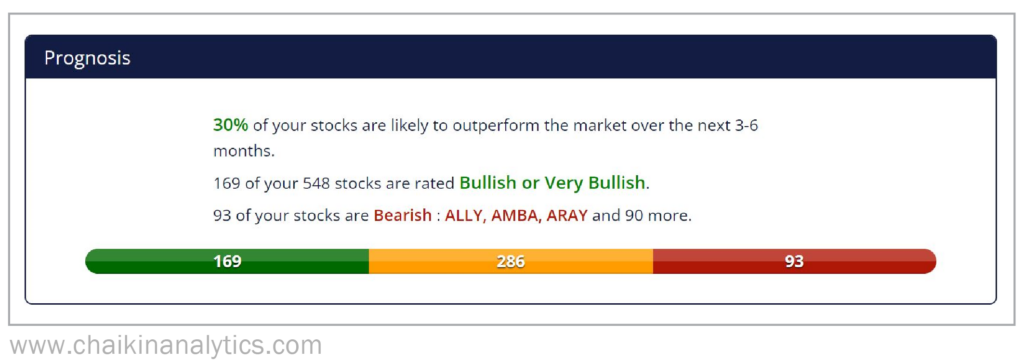

First, let’s look at the ratio of “bullish” to “bearish” stocks in KOMP. The ETF currently owns shares of roughly 550 companies with Power Gauge rankings.

As you can see in the Prognosis section of the ETF’s Health Check report below, 30% of these stocks are rated as “bullish” or better today. Take a look…

That’s a solid result, given today’s tough market environment. So let’s keep digging.

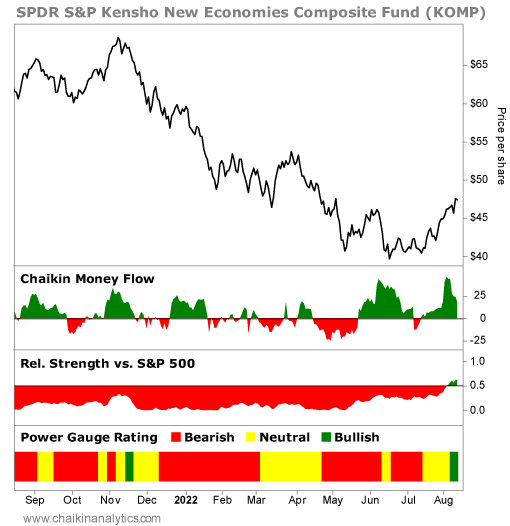

Next, we’ll analyze the ETF’s overall chart. Take a look…

I recommend reading the chart from the bottom up, in this order…

- Notice that KOMP recently turned “very bullish” based on the bottom green band.

- Its relative strength is just starting to improve. That change might seem miniscule. But it’s noteworthy considering the ETF underperformed the S&P 500 Index for the past year.

- Lastly, notice the strong buildup in the Chaikin Money Flow indicator. That tells us the “smart money” is getting behind this investment.

Folks, for the first time in at least a year, KOMP is setting up well on multiple signals.

KOMP holds a broad basket of mostly U.S.-based “new economy” stocks. And like other innovation-focused ETFs, it’s showing signs of life for the first time in a while. (My colleague Marc Gerstein detailed this trend change last Wednesday.)

That’s intriguing.

I’ve added KOMP to my watch list. I’m glad the Power Gauge helped me spot it. And if you’re looking for a “new economy” investment, you should consider it as well.

Good investing,

Pete Carmasino