It’s hard to find any bright spots as an investor right now…

The stock market is in shambles. Central banks around the world are hiking interest rates. And traditional “safe havens” such as gold and bonds aren’t helping at all.

In these turbulent times, we need some sort of “fortress” to protect us.

The good news is… we already have one.

As you might recall, in our May 18 issue, I introduced the iShares Select Dividend Fund (DVY) as a “not-so-glamorous recession fortress” to consider during these tough times.

Now, at least technically speaking (two quarters of declining gross domestic product), the recession is here. Today, we’re concerned about its duration – and how bad it could get.

But fortunately, those folks who’ve hunkered down in DVY should feel good. And as I’ll show you today, it’s not too late to consider joining them if you haven’t already…

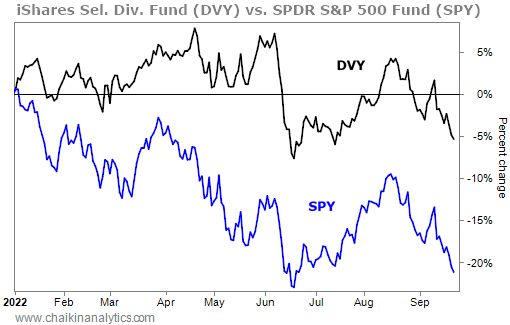

In short, since the stock market turned lower in January, DVY has followed the script. It has significantly outperformed the SPDR S&P 500 Fund (SPY) in that span. Take a look…

The S&P 500 Index peaked on the first trading day of this year. As you can see, the index-tracking SPY is down about 22% since then. Meanwhile, DVY is only down around 5%.

At first, you might think this significant outperformance is at least partially due to DVY’s higher yield (roughly 3% versus about 1.5% for SPY). But that isn’t the case…

The above chart only shows the price action of the two exchange-traded funds (“ETFs”) over that span. Factoring in dividends only boosts DVY’s margin of victory so far this year.

Having said that, dividends do play a role in this outperformance. The main edge for this recession fortress comes from the kinds of stocks it owns…

You see, financial theory says businesses should pay out dividends if shareholders can reinvest the money more profitably than the company can. And on the flip side, businesses with better reinvestment opportunities should “retain” the income to do that.

A little more than half of SPY’s holdings are in the information technology, health care, and consumer discretionary sectors. Corporate boards, fund managers, and shareholders usually assume that these types of companies can reinvest more profitably.

Therefore, many of these companies retain large portions of their profits. And more than half of them don’t pay dividends at all.

Meanwhile, DVY invests nearly 60% of its portfolio in the utility, financial, and consumer staples sectors. Companies in these sectors typically pay out about 30% of their earnings as dividends.

These dividend-paying businesses don’t often soar to the moon in good times – like many high-flying tech stocks. But in bad times, they’re less likely to crash and burn.

That’s the blueprint for a recession fortress.

It’s why DVY has significantly outperformed SPY since the market turned lower in January. And looking ahead, this trend seems likely to continue…

During the most recent bull market, stocks benefited from falling interest rates. That’s not in the cards anymore. As we’ve said lately, we’re now in a “stock-picker’s market”…

Company merit matters more than ever. And the Federal Reserve will no longer save investors if they make any missteps.

Also, keep in mind that oversized positions in five companies propelled the S&P 500 higher for many years. With investors continuing to chase growth, Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), and Tesla (TSLA) all soared during the bull market.

But as the recession lingers over us, many folks aren’t as eager to chase growth potential these days. Instead, they’re leaning on DVY to lead them through these tough times.

Consider joining them with this recession fortress before it’s too late.

Good investing,

Marc Gerstein