Once again, the mainstream media is a step behind…

Until recently, the media was driving the narrative of a “fake” recession. And like the government, many financial pundits reasoned that the economy wasn’t really that bad.

But now, the talk about a recession is getting bolder. Terms like “consumer demand” and “Producer Price Index” are starting to dominate the headlines.

Put simply, demand for goods is dropping…

When a drop in demand occurs, it means the economy is slowing down. And an economic slowdown is a telltale sign of a recession.

But the thing is… the media is focused on the wrong chapter of this story.

You see, a lot of smart folks have already moved on to the next chapter…

A major change is playing out in how Wall Street experts interpret the Federal Reserve’s actions. And as I’ll explain, it will have big consequences for everyday investors like us…

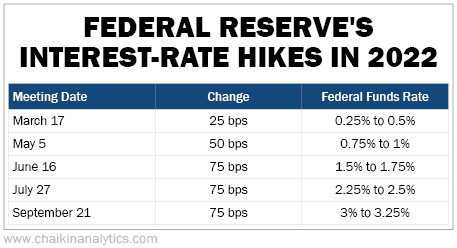

The Fed has imposed five interest-rate hikes over the past seven months. And as you can see in the following table, these hikes have gotten progressively larger…

In March, the Fed started with a rate hike of just 25 basis points (“bps”). It quickly moved to a 50-bps hike in May. And the past three increases each clocked in at a staggering 75 bps.

Remember, the “federal funds rate” was effectively zero at the beginning of this year. And it’s now in a target range between 3% and 3.25%. That’s a pretty steep jump.

But according to one of my favorite indicators… the Fed could start acting less aggressively.

The indicator is the “fed funds futures.” We discussed it in detail on August 22. Essentially, it tells us what the experts on Wall Street expect to happen with interest rates…

These experts base their bets on Fed communications and how they interpret the economy’s health. In other words, it’s how they show us their feelings about the state of the world.

That makes it one of the best economic-sentiment indicators available to folks like us.

Two weeks ago, CME Group’s FedWatch Tool indicated a roughly 70% chance of another 75-bps hike at the Fed’s next meeting in early November. But that expectation is dropping…

The FedWatch Tool’s prediction fell to a nearly even split between projections of 50 bps and 75 bps last week. And in the past few days, it has fluctuated between the original, more pessimistic prediction and the more optimistic one.

The point is this… these experts were nearly certain that the Fed would announce another massive 75-bps hike at its next meeting. But now, they’re not so sure.

In other words, the market expects rates to keep rising – but not as much as before.

This is a huge shift in sentiment. And it will lead to real-world outcomes for investors.

You see, if the Fed starts slowing its rate hikes, it tells us three things…

- The Fed is either winning the war against inflation, or it’s concerned that the recession momentum is growing too quickly.

- By extension, consumer demand is falling.

- The post-inflation recessionary stage is closer than ever.

Taken altogether, it means we’re seeing our first major glimmer of hope amid the current economic storm. And it’s one that will eventually lead to growth…

While I don’t expect that to happen in the near future, it’s a sign that we’re taking our first baby steps in that direction.

The media has moved on from the “fake” recession to the real recession we’re facing today. But it’s still behind the experts on Wall Street…

They’re already looking toward a gentler policy stance from the Fed.

Sentiment is shifting. So for now, our takeaway is simple…

Be patient. Build your nest egg. And prepare to put it to work when the time comes.

Good investing,

Karina Kovalcik