After more than two years, you’ve likely heard enough about supply-chain problems…

The initial COVID-19 shutdowns in 2020 first brought the issue out into the open. And worker shortages led to continued struggles even after those shutdowns ended.

Bottlenecks at major global ports spread throughout 2021. You likely saw images on the nightly news of cargo ships lined up off the coasts of many countries.

Ongoing geopolitical turmoil is making it worse…

The Russia-Ukraine war drags on. And sure, the U.S. and China aren’t shooting at each other. But the tension between the two superpowers is growing almost every day.

Now, I want you to think back to the markets…

How often have companies blamed their disappointing results on supply-chain problems?

It’s a major issue these days. If companies can’t transport their goods, their sales will suffer. And for investors like us, that makes it challenging to find places to put our money.

Fortunately, as I’ll explain today, some companies can benefit in this evolving world…

The Power Gauge currently points to a great way to invest in a solution to our supply-chain woes. And you’ve likely never heard of this company before…

The supply-chain bottlenecks are causing more U.S. manufacturers to shift their strategies. They’re spreading business among several suppliers nowadays. And beyond that, they’re turning to different regions…

The 30 biggest U.S. manufacturers sought goods from six times more Mexican suppliers last year than in 2020. And they pursued bids from 9% fewer Chinese companies.

In other words, major U.S. manufacturers are essentially transferring their operations from China to Mexico.

This shift is great news for Mexican airports. Increased trade means more people are moving around the country. And naturally, many of these folks travel to Mexico by air.

Today, the Power Gauge is telling us to look at one Mexican airport operator in particular…

It’s officially known as Grupo Aeroportuario del Centro Norte S.A.B. de C.V. (OMAB). But to most folks, the company is simply known as OMA.

OMA operates 13 airports in Mexico. And its business model is easy to understand…

The more flights and passengers out of OMA’s airports, the more revenue it generates.

The company makes most of its money from various airline fees. Airlines need to pay fees to airport operators for virtually everything – including passenger counts, landing rights, walkways, plane parking, and security.

This segment produced about 60% of OMA’s total revenue in the second quarter.

The rest of its revenue comes from many different sources. The company makes money from parking fees, restaurants, retail shops, VIP lounges, advertising, and more.

And right now, business is booming for OMA. Through the first nine months of this year, total traffic in the company’s airports rose more than 32%.

Despite that jump, air travel in Mexico remains lower than many other countries…

A recent industry analysis found that annual per-capita flights in Mexico equal 0.5. That’s less than half as much as the 1.1 in Chile (Latin America’s leader). And the U.S. comes in at 2.8.

So a lot of growth potential remains with OMA. And the so-called “smart money” sees that…

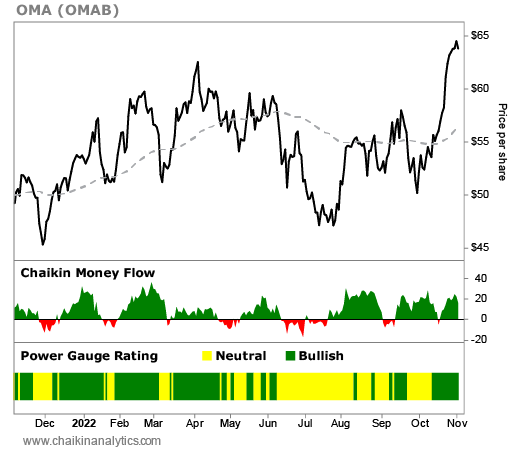

Remember, our Chaikin Money Flow indicator shows us what the smart money is doing. It measures the buying patterns of Wall Street institutions and other power players.

Smart-money accumulation is a strong sign that a stock is ready for a big bull run. And as you can see, this indicator has been strong for OMA for much of the past year…

If that’s not enough, OMA is attracting another big backer…

At the end of July, France-based infrastructure conglomerate Vinci (VCISF) agreed to take a 30% stake in the company. And Vinci isn’t going to be passive. It plans to support OMA by incorporating the best practices from its existing multinational network of more than 50 airports.

Like many other investments, OMA’s stock languished through the first nine months of 2022. It was down roughly 7% at the end of September.

However, it has been on a tear over the past month. The stock is up around 28% in that span.

After such a drastic move higher, you might want to wait for the next “breather” to get in.

But make no mistake…

OMA is a great way to capitalize on the world’s evolving shipping and manufacturing trends. And thanks to the Power Gauge, it’s now on our radar.

Good investing,

Marc Gerstein