With so many “buy” ratings today, it’s like Wall Street analysts have become ostriches…

They’re simply sticking their heads in the sand and ignoring everything around them.

They’re so far behind when it comes to a couple of market sectors, it’s frightening. To put it bluntly, I wouldn’t want to be someone who follows these analysts’ ratings.

Analysts held 10,708 ratings on S&P 500 stocks as of last week, according to FactSet. Of that total, 56.9% were “buy” ratings, 37.7% were “hold” ratings, and only 5.4% were “sell” ratings.

And the thing is, even though we’re mired in a bear market right now… the current breakdown is almost spot on with the five-year averages. The five-year averages are 53.3% for “buy” ratings, 40.7% for “hold” ratings, and 5.5% for “sell” ratings.

That brings up a simple question…

What are these analysts seeing – or better yet, not seeing – in the market today?

And that isn’t even the worst part of the data…

A sector-level look gives us an idea of what’s wrong with these Wall Street analysts today. Their ratings reveal a profound lack of understanding of the current market dynamics.

These analysts hold “buy” ratings on 65% of stocks in the information technology sector. And they have “buy” ratings on 61% of stocks in the communications sector.

Analysts are most optimistic on these two sectors (as well as energy at 64% “buy” ratings). But the thing is… these two sectors have performed the worst during this bear market.

The Technology Select Sector SPDR Fund (XLK) tracks the information technology sector.

Our Power Gauge system downgraded XLK to “neutral” on January 5. At the time, it traded for more than $168 per share.

As our chief market strategist, I review various ratio charts for a select group of our subscribers each week. And on April 6, I told folks to continue to avoid the space despite a rally over the previous few weeks. XLK traded for around $155 per share at the time.

The exchange-traded fund closed yesterday at about $129 per share. That’s a roughly 23% decline in about five months since the Power Gauge urged folks to be careful. Take a look…

Despite that abysmal performance, Wall Street analysts continued to hold “buy” ratings on roughly 65% of these stocks as recently as last week. It’s crazy…

How far must tech stocks fall before the analyst community downgrades the sector?

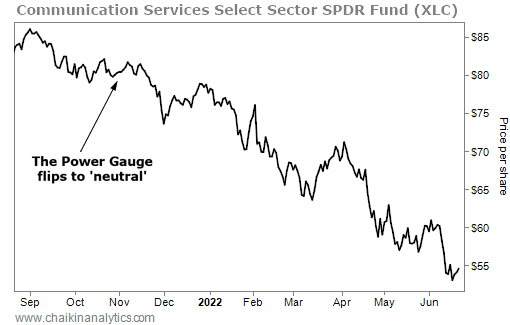

The Communications Services Select Sector SPDR Fund (XLC) is in a similar position…

The analyst community still rates 61% of the stocks in this sector as a “buy” today. And yet, the evidence doesn’t support that outlook…

The Power Gauge downgraded this sector from “bullish” to “neutral” on November 1, 2021. That day, XLC traded for around $80 per share.

Then, in our weekly sector review on November 17 for the same group of subscribers, I downgraded the stock as well. It traded for about the same price as two and a half weeks earlier.

Now, XLC trades at roughly $55 per share. That’s a decline of about 32% in less than eight months. That’s an incredible drop for an entire sector. Take a look…

Folks, the analyst community simply lacks the capacity to update their ratings as dynamically as we can with the Power Gauge and in our daily insights. And right now, investors are paying the price.

The truth is… it’s hard to say exactly why Wall Street analysts often get things so wrong. Maybe it’s because their jobs depend on an outlook that motivates investors to buy.

Whatever the reason is, these analysts will fail you as an investor. Their full-tilt “buy” ratings while investors are getting crushed proves that.

But when you need an edge… don’t look to Wall Street.

Instead, do what we do. Lean on the “just the facts” breakdown from the Power Gauge.

Good investing,

Pete Carmasino